It was a series of life events that brought me to the real estate industry. Growing up, I thought I’d be a teacher, then a psychiatrist, then a counselor. Instead, my BS degree is in accounting – about as far as you can get from the people-focused career visions of my younger self. I held positions with titles like Accounting Manager and Controller and picked up a variety of new skills along the way, including managing a team of people, writing policies and guidelines, making effective presentations, planning and budgeting, managing communication and more. This newly expanded combination of skills led to the position of Chief Executive Officer of the Realtor® Association of the Sioux Empire, Inc. (RASE) for nearly 10 years.

In 2005, I finally caved in to my husband Jim’s request that I join his commercial real estate team. I haven’t looked back since. Commercial real estate offers me the people-centric career I crave while still utilizing the skills I’ve spent a lifetime acquiring. Nothing happens in real estate without people – a property owner, investment buyer, prospective tenant, cooperating broker, a vendor – each encounter provides me an opportunity to be helpful in some way, whether that be to complete a financial analysis of a property, conduct a market search, research opportunities, tour properties, review financial reports, analyze property tax assessments, or just brainstorm ideas. If the agent with the most listings wins, I’ll lose every time! My focus is on providing a deep level of service to the clients I’m working with and creating lasting professional relationships, not on constantly building my deal pipeline. I like going home at night knowing that people are counting on me, and that I am going to help them achieve a milestone in their lives. Ready for your next milestone? Let’s talk – I’d love to hear about your commercial real estate goals! If my team isn’t the right fit for your needs, I’ll let you know – and I’ll provide next steps or recommendations for you whenever I can, so you’ll have a take-away from our time together.

To your continued success!

This month of love was filled with heartwarming success stories featured by The Sioux Falls Business Journal, from the commercial real estate world. The success stories within the ever-changing landscape of property investment are inspirations and lessons for both the newbies and the veterans. In this blog post, it would bring to light how smart the real estate investments have turned out to be a great achievement, surely representing the strength of strategic planning combined with market understanding.

Read more

As the chills of Halloween hover around the corner, it’s the perfect time to discuss an increasingly used term in the financial world – ‘zombie company’.

Read more

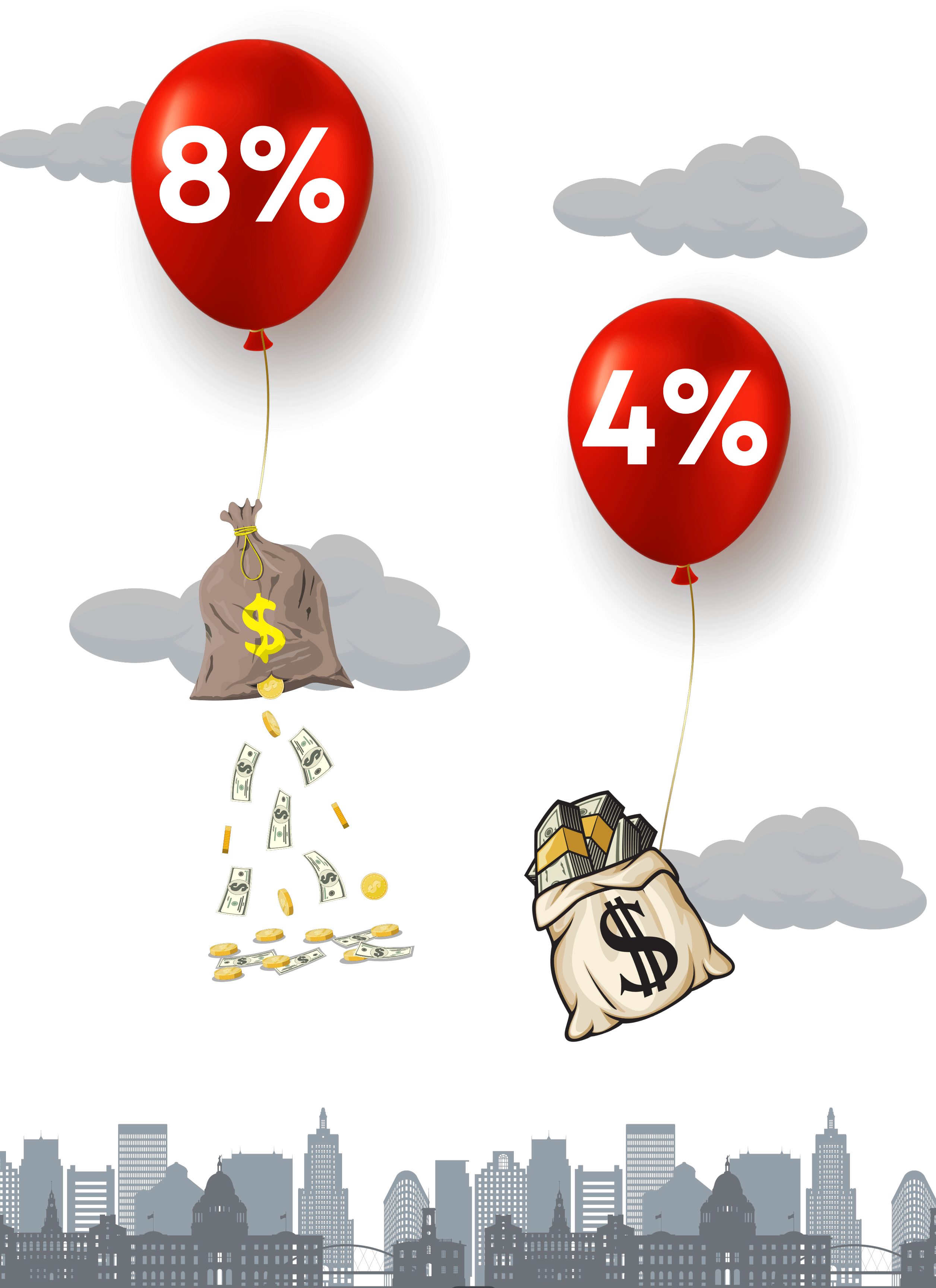

I’ve been thinking a lot about balloons.

Not the pretty red ones that float into infinity if you let go of the string. I love those balloons!!

I’m talking about loans with a balloon payment.

I have some of those balloons, but I do not love them. I love them even less with the increase in interest rates. A lot, lot less.

Conventional loans for commercial real estate – owner-occupant or investment properties – are not fixed for 15 to 30 years like a residential loan. The term is negotiable, but the longest term we (Jim and I) have negotiated is a 10-year rate lock. In our situation, the most recent rate locks have been 5 to 7 years before the balloon payment looms.

Read more

Owning commercial investment real estate can be both rewarding and demanding. As an owner who self-manages their property, you’re familiar with the unique challenges and responsibilities that come with this role. One key task that should never be left to the last minute? Preparing your NNN (triple net lease) estimates for the upcoming year. With the year drawing to a close, now is the time to plan, prepare, and ensure a seamless experience for both you and your tenants.

Read more

As a property owner in the Sioux Falls, SD metropolitan area, you may be wondering how to achieve above market selling prices on your commercial real estate in an environment of rising interest rates. The answer is assumable financing.

Read more

Many people work hard and save diligently with the end goal of creating a solid financial foundation. However, with unpredictable markets and economic uncertainty, it can be challenging to know where to invest your hard-earned money. Luckily, commercial investment properties offer an exciting opportunity for those seeking financial stability.

Read more

If you’re looking to start or expand your business, you may be wondering if it’s better to buy or rent a commercial property. The decision ultimately comes down to what makes the most financial sense for your business.

Read more

The debate between leasing and owning has been long-standing in the business world, with valid arguments for both sides. But which option should you choose for your long-term success?

Read more

A lease vs. buy analysis is a financial tool used to compare the costs and benefits of leasing versus buying a piece of property or equipment. The analysis takes into account various factors, such as the length of the lease or financing term, the interest rate, depreciation, tax benefits, maintenance costs, and expected usage.

Read more

As the economic landscape continues to shift in response to a multitude of factors, rising interest rates are beginning to make their mark on commercial property markets. From increased borrowing costs for developers and investors, to shifting tenant demand and decreased affordability, these changes can have far-reaching effects that go beyond just the immediate impact on property values. Interest rates can have a significant impact on the commercial property market, and if you’re an investor or seller, it’s essential to understand how they affect sales prices. With interest rates on the rise in recent years, it’s necessary to keep up-to-date with the latest trends and predictions.

Read more