I’ve been thinking a lot about balloons.

Not the pretty red ones that float into infinity if you let go of the string. I love those balloons!!

I’m talking about loans with a balloon payment.

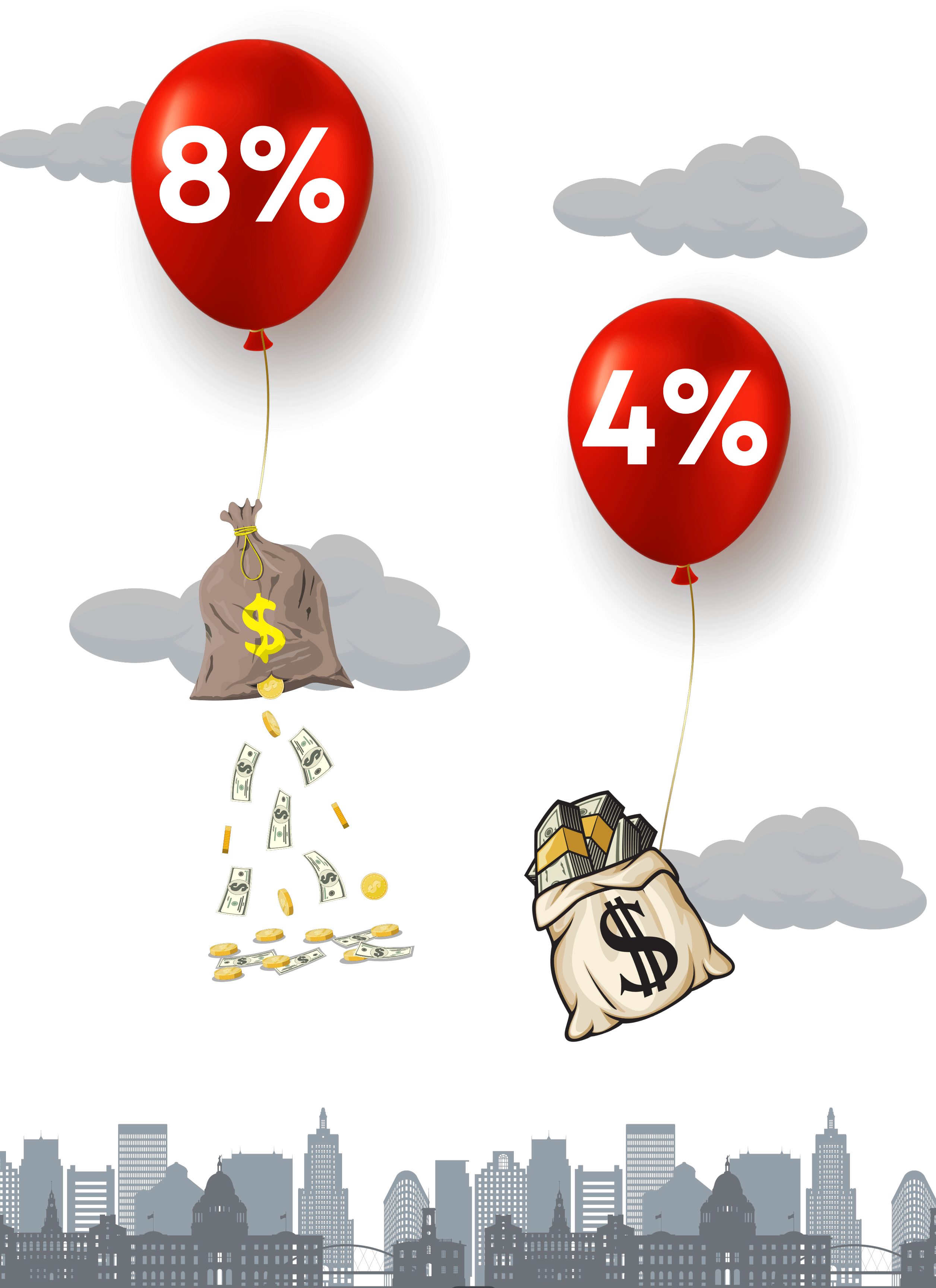

I have some of those balloons, but I do not love them. I love them even less with the increase in interest rates. A lot, lot less.

Conventional loans for commercial real estate – owner-occupant or investment properties – are not fixed for 15 to 30 years like a residential loan. The term is negotiable, but the longest term we (Jim and I) have negotiated is a 10-year rate lock. In our situation, the most recent rate locks have been 5 to 7 years before the balloon payment looms.

When considering an investment opportunity or calculating occupancy costs, buyers run the numbers under different scenarios to estimate the risk.

But how many people assumed an 8% or 9% interest rate in their calculations? Interest rates have been so low for so long that people fantasized it would last forever. Or they felt conservative using a 6% rate. Unfortunately, that’s already 2 to 3 percent below current rates.

For some borrowers, a balloon means negative cash flow. They will need to write a monthly check for some or all of the property expenses. Not everyone is prepared for a property to go from positive to negative cash flow. And that’s a real problem.

Over the last few years, low rates of returns reflected a focus on debt reduction and minimal cash flow. But there are benefits even then – your business (owner-occupant) or your tenants (investors) pay down your loan, you recognize depreciation on your tax return and save taxes. Eventually, your building is paid off. Win-win!

Since I’ve been thinking about balloons for a while, we bit the bullet and paid to refinance 7 loans in 2022 to extend the 3.5% interest rate for another five years. (I told you I had balloons!) That’s going to save tens of thousands of interest dollars during the extended term. That’s planning. And that’s what I want you to do – start planning for your upcoming balloon.

I’ll be talking about balloons for the foreseeable future. This is both because I like balloons (the kind that float on a string anyway!) and because I want everyone who has a balloon payment on the horizon to be prepared.

Are you going to float (refinance) your balloon? Does it still have enough helium to satisfy underwriting? Are you going to pop (pay off) your balloon with saved funds or outside investors? Or are you going to release your balloon into the sky with a sale or a sale-leaseback?

Knowledge is power. Want to discuss options? Contact Jim Dunham & Associates today. We’ll even throw in a free balloon when you stop in!

Comments (0)