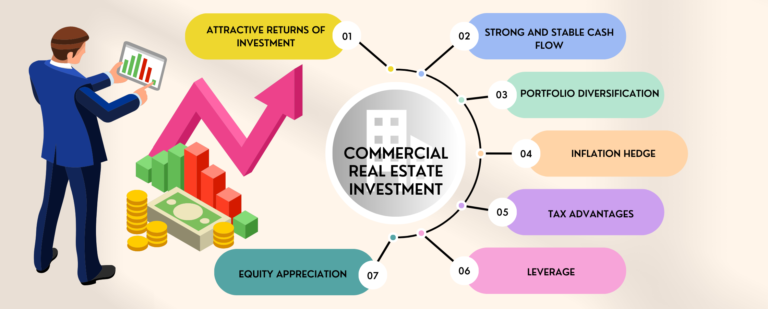

Discover the Advantages of Diversifying Your Investments with Commercial Properties

As a savvy investor, you’re always on the lookout for opportunities to grow and diversify your portfolio. One of the most enticing investment options is commercial real estate, and for good reason. In this blog post, we’ll explore the numerous benefits of investing in commercial properties and how they can elevate your investment game to new heights.

1. Attractive Returns on Investment

Commercial real estate investments often yield higher returns than other investment options. With higher rental rates, longer lease terms, and potentially greater appreciation, commercial properties can be a profitable addition to your portfolio.

2. Stable Cash Flow

Tenants in commercial properties generally sign long-term leases, ensuring a consistent and reliable stream of rental income. This stability can help smooth out fluctuations in your portfolio and provide a solid foundation for future growth.

3. Portfolio Diversification

Diversifying your investments reduces risk and can lead to greater overall returns. By adding commercial real estate to your portfolio, you can benefit from the unique market factors and performance characteristics of this asset class, further diversifying your investment strategy.

4. Inflation Hedge

Commercial real estate investments can act as a hedge against inflation. As the cost-of-living increases, so do commercial property rents, helping your income keep pace with inflation and preserving your purchasing power.

5. Tax Benefits

Investing in commercial real estate can offer attractive tax benefits, including depreciation deductions and the ability to defer capital gains through 1031 exchanges. Consult with a tax professional to understand how these benefits can impact your overall investment strategy.

6. Leverage

Commercial properties typically allow for greater leverage than residential properties, enabling investors to control a more valuable asset with a smaller initial investment. This can boost potential returns and help you grow your portfolio more quickly.

7. Equity Appreciation

As your commercial property increases in value, so does your equity. This appreciation can be realized through refinancing or selling the property, providing you with additional capital to reinvest or use as you see fit.

Investing in commercial real estate offers a multitude of benefits, from attractive returns and stable cash flow to portfolio diversification and tax advantages. By understanding these benefits and carefully considering your investment strategy, you can tap into the enormous potential of commercial properties and elevate your investment game.

Comments (0)